MACRO LEVELQuote:

Taylor Morrison CEO: There's certainly housing demand but we're not seeing the typical spring surge

- UST10Y still 30bps off its high in January, however, still elevated. Maybe more relief in sight if these trade agreements start falling into place. However, some tariffs are likely to stay so it remains to be seen how much relief we could get.

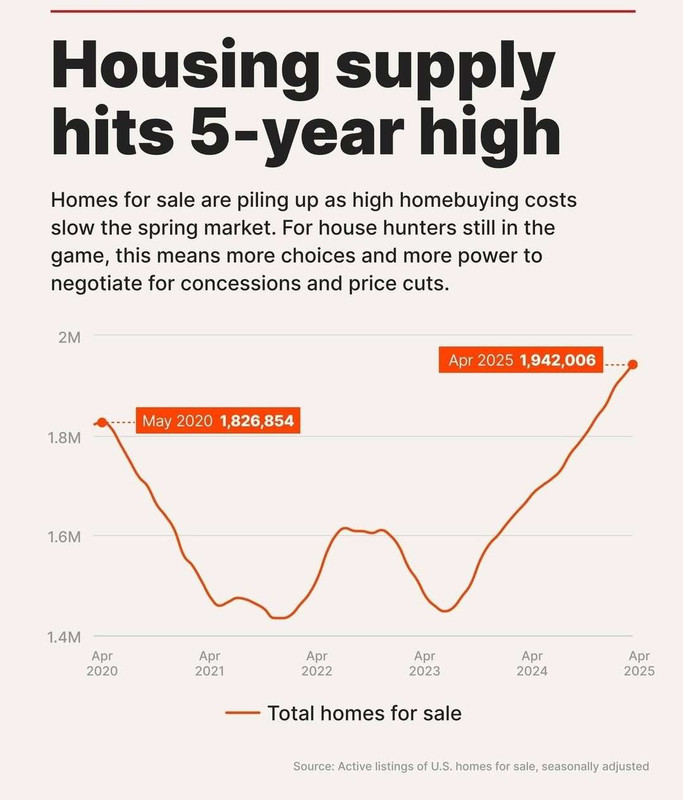

- Affordability is top of mind in this stage of the RE cycle. Value gains over the past 5 years coupled with persistently high interest rates have hampered affordability, causing people to forego upsizing/upgrading and remaining in place or renting.

- Taylor Morrison's CEO on CNBC this past week said that they are not seeing the typical surge of buyers for the busy season, which is concerning given home builders have more levers to pull when it comes to buyer concessions/rate buydowns.

NORTH TEXAS

- Inventory increase finally started to take a dent in price increases metro wide.

- Median Price is down 1.2% YoY to $400k.

- Active listings up 39.5%!

- Months of Inventory now at 4.3 and days on market at 88

- Interestingly, the number of closed sales is also down (4.7%). We had been seeing growth until this point aided by the increases to inventory forcing more sales. That has now flipped indicating that even with growing inventory, houses are not moving as quickly.

- Playing around in the MLS data and I found this graph. Check out the decrease in homebuyer tours for the average listing on the MLS. Corroborates all of the above. Sometimes the first offer might be the best one.

Sponsor Message: We Split Commissions. Full Service Agents in Austin, Bryan-College Station, Dallas-Fort Worth, Houston and San Antonio. Red Pear Realty