There are currently reports circulating that Fed Chair Powell has "officially resigned."

— The Kobeissi Letter (@KobeissiLetter) July 22, 2025

These reports are FAKE.

Fed Chair Powell has yet to even discuss a possible resignation.

And, in his comments this morning, Powell did NOT discuss any topics pertaining to a resignation.

Let's debate interest rates.......Trump vs Powell who is correct?

This is fake right?

Parks & Rec caliber stuff. https://t.co/XrCi6FuDRO

— Bob Sturm (@SportsSturm) July 25, 2025

Quote:

SMH....... This will really help governments around the world with their confidence in the US Financial system.

This is fake right?

"It just came out."

"This came from us?"

"You are including the Martin renovation. You just added in a third building"

"It is a building that is being built."

"It was built five years ago. We finished Martin over five years ago"

NSFW....

Jim Cramer dropping an F bomb today

— Inverse Cramer (@CramerTracker) July 28, 2025

Instant classic pic.twitter.com/7EtZsvwKKp

Quote:

this morning on CNBC, where panelists talked about domestic growth and rates, leading frustration to apparently spill over with Jim Cramer. "Our biggest problem is we have so much growth that the Fed won't cut...what the f*ck..." Cramer said on live television, before apologizing to viewers.

"Jesus Christ," someone is heard saying in reaction to the comment, as the profanity became contagious.

https://www.zerohedge.com/markets/what-fck-jim-cramer-snaps-live-television-rate-cut-frustration-boils-over

https://www.federalreserve.gov/newsevents/calendar.htm

Agenda for 7/30

1:00 p.m.

CP - Commercial Paper

2:00 p.m.

FOMC Meeting

Two-day meeting, July 29-July 30

Press Conference

4:15 p.m.

H.15 - Selected Interest Rates

Do we see Trump's head explode tomorrow afternoon or does Powell give in to a .25% cut just to shut him up?

Krombopulos Michael said:

https://www.federalreserve.gov/newsevents/calendar.htm

Agenda for 7/30

1:00 p.m.

CP - Commercial Paper

2:00 p.m.

FOMC Meeting

Two-day meeting, July 29-July 30

Press Conference

4:15 p.m.

H.15 - Selected Interest Rates

Do we see Trump's head explode tomorrow afternoon or does Powell give in to a .25% cut just to shut him up?

Powell won't move the rates. He will burn the country down before he lets Trump "win".

from the X post:

Quote:

Key risks to watch:

Tariff-driven inflation (Trump-era policies)

Labor cooling without a recession

Q4 disinflation pace

I expect Trump to drop some F bombs on his platform, despite being completely wrong on this!

eta: there is no meeting in August, so September is earliest for a cut if it doesn't happen tomorrow

FED WEEK: DECISION EXPECTED, GUIDANCE CRITICAL

— *Walter Bloomberg (@DeItaone) July 29, 2025

Kalshi assigns a 97% chance of no rate change (holding at 4.25–4.50%) at the July 30 meeting. The real focus: forward guidance.

🔍 Market expects 2 cuts by Jan 2026, but timing is uncertain. The dot plot and Powell’s tone will… pic.twitter.com/dCgC0UyuXJ

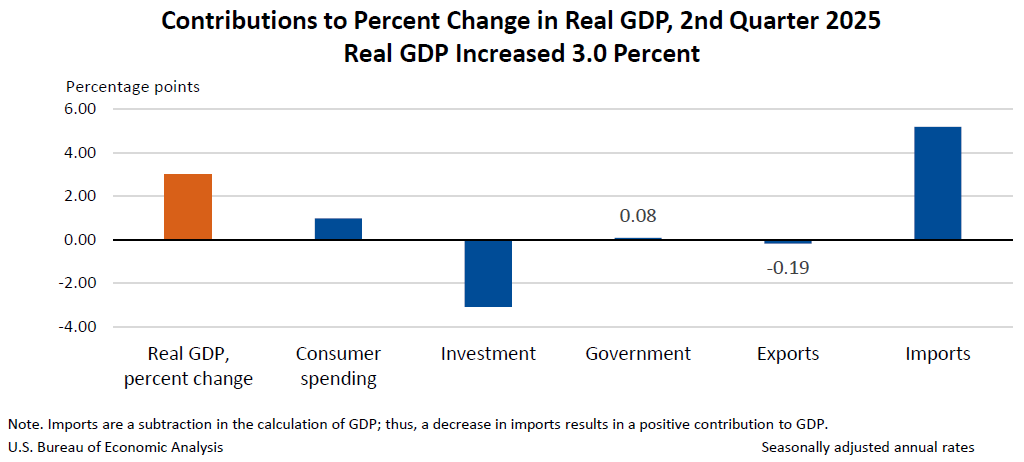

US Q2 GDP initial estimate 3.0%, Exp. 2.6%, Last -0.5% pic.twitter.com/BXGUbAu5jP

— zerohedge (@zerohedge) July 30, 2025

Trump can take the interest rate win or the overall economy win.

Powell might give him a .05% move higher just to be a #$@.......

Doesn't make sense -- he's off his rocker on this.

TRM said:

I'm skeptical about this quarter's results without looking at the components. Last quarter's negative results were driven in large part by the import rush before the liberation day tariffs and these results are skewed by that same rush - no need to import in Q2 because you already ordered it in Q1. I suspect the results above expectation is driven by the net export number.

I agree, there's been a lot of churn since April and it's next to impossible to clearly discern what's happening. 2025 will be a year of transition, and it will be 2026 before we really understand the collective impact of trade policy, tax policy, and government spending. I could see it going either way... just have to wait and see.

Quote:

I'm skeptical about this quarter's results without looking at the components. Last quarter's negative results were driven in large part by the import rush before the liberation day tariffs and these results are skewed by that same rush - no need to import in Q2 because you already ordered it in Q1. I suspect the results above expectation is driven by the net export number.

The numbers show a retreat from surge import buying. Imports spiked 40% QOQ in the last report but then shrank 30% in this report.

MemphisAg1 said:

Strong economic growth and the jobs picture is better than expected, yet Trump is hammering the Fed again today for rate cuts.

Doesn't make sense -- he's off his rocker on this.

Posters hating on Powell but who similarly feel the economy is doing decent under Trump thus far can't have it both ways. Either the Fed has been doing the wrong thing not yet lowering rates and the economy has been suffering for it, or they have been doing the right thing thus far.

A Polymarket whale bet $2.4 million that Powell won't cut rates today.

— Polymarket Whales (@PolyWhaleWatch) July 30, 2025

They'll win $2.5 million if rates remain the same.

Smart bet?

👉https://t.co/dtxtGlVF5c pic.twitter.com/aBIFNLvWcV

Logos Stick said:

Someone just bet $2.4 mil that Powell won't cut today!

Probably Powell himself.

I see no way they cut rates. That clown won't let Trump have a win. He's a leftist.

https://www.conference-board.org/research/global-economy-briefs/gdp-q2-2025-analysis

Quote:

Q2 GDP Shows Sizable Slowing Beyond Trade Fog

July 30, 2025

GDP spiked in Q2, but looking through the tariff-related dislocations in consumer and business behavior, the underlying pace of growth slowed significantly.

- The economy rising at 3.0% q/q SAAR in Q2, on the back of a 0.5% decline in Q1 reflected massive dislocations in the underlying components of growth. Such noise suggested the need to look at the underlying demand, which slowed significantly since last year. With the gauge for Q2 coming in very close to our expectations (2.8%), we estimate GDP growth will likely remain tepid going into H2 and reach a low point in Q4.

- Consumer spending may continue to run weak, as rising prices weigh on real consumer demand, while investment may recover somewhat from a near-freeze in Q2, as uncertainty surrounding the fiscal outlook and tariffs diminishes.

- GDP excluding volatile trade and inventory contributions, the gauge which is considered a better reflection of the underlying strength in the economy, increased at a sluggish rate of 1.1% q/q SAAR.

Essentially imports freezing up during the quarter drove most all of the gain while the stuff you really need to ride over the long term, consumer spending and business investment, got worse.

SUMMARY OF FED DECISION (7/30/2025):

— The Kobeissi Letter (@KobeissiLetter) July 30, 2025

1. Fed leaves rates unchanged for 5th straight meeting

2. Fed voted 9-2 to keep interest rates unchanged

3. Indicators suggest growth of economy moderated

4. Inflation in the US remains "somewhat elevated"

5. Unemployment rate remains low…

BREAKING: President Trump issues a statement after Fed Chair Powell holds interest rates unchanged for the 5th-straight time:

— The Kobeissi Letter (@KobeissiLetter) July 31, 2025

Trump says Powell is “too late, too angry, too stupid, and too political.” pic.twitter.com/hgqygjIFRy

Not quite a head exploding moment......7 out of 10 rant.

BTW anyone else think he's going to use the whole building renovation thing to push for a full audit of the Fed in the next couple years?

BREAKING NEWS

— Gold Telegraph ⚡ (@GoldTelegraph_) August 1, 2025

THE PRESIDENT OF THE UNITED STATES IS CALLING ON THE FEDERAL RESERVE'S BOARD OF GOVERNORS TO USURP THE POWER OF FED CHAIR

Wow.

President Trump just fired the BLS Commissioner:

— The Kobeissi Letter (@KobeissiLetter) August 1, 2025

But, the downward jobs revisions may be EXACTLY what Trump needed to get Powell to cut rates.

The Fed will only cut rates if inflation sustainably falls to their 2% target OR if the labor market weakens.

The -258,000 downward…

Quote:

The -258,000 downward revision today along with the weak July number actually increased the odds of a September rate cut to 80%+.

He's really really desperately trying to get that rate cut. The next 60 days until the next FOMC meeting are going to be lit......

Quote:

BTW anyone else think he's going to use the whole building renovation thing to push for a full audit of the Fed in the next couple years?

He can ask for one, but the Senate and House are likely going to be in some mix Democrat control and Fed oversight is their purview so they will tell him to go pound sand.

I am just waiting for the courts to freeze and roll back his abilities to levy tariffs under the emergency powers act. That is going to really make his head explode.

If he can't get a rate cut prior to September meeting, I think he'll go full blown scorched Earth.

I'm not a Trump fan but I can back him on fighting and destroying the Fed.

Quote:

He's just starting to apply the pressure IMO.

If he can't get a rate cut prior to September meeting, I think he'll go full blown scorched Earth.

I'm not a Trump fan but I can back him on fighting and destroying the Fed.

Supreme Court has already signaled he has no real power with the Fed. Markets and business leaders don't want disruption to the Fed. They will yank his leash like they did in April and he will suddenly start *****ing about something else.

Likeliest outcome.

Windy City Ag said:

I am just waiting for the courts to freeze and roll back his abilities to levy tariffs under the emergency powers act. That is going to really make his head explode.

Yeah, I think that's likely.

Then where do we go? All those tariffs will have to be refunded, which means the Treasury will have to make up the difference with borrowing. And then Trump will just try to reimplement tariffs using other laws on the books... adding to ongoing uncertainty.

Quote:

Yeah, I think that's likely.

Then where do we go? All those tariffs will have to be refunded, which means the Treasury will have to make up the difference with borrowing. And then Trump will just try to reimplement tariffs using other laws on the books... adding to ongoing uncertainty.

In a perfect world Mike Johnson would get Congress to stand up and re-assert its constitutional authority in the matter.

Doubt that will ever happen though.

If it's not Trump, the BRICS will.

The whole crypto Genius Act appears to be the infrastructure for the off-ramp from central money authority.

Giving corporations and banks the authority to create digital financial instruments that can be used as currency really undercuts the Fed.

Respect - the old fashioned way! https://t.co/C4CGEBCUb9

— Reggie Middleton US11196566 US11895246 US12231579 (@ReggieMiddleton) August 1, 2025

Quote:

The whole crypto Genius Act appears to be the infrastructure for the off-ramp from central money authority.

Giving corporations and banks the authority to create digital financial instruments that can be used as currency really undercuts the Fed.

No government wants to relinquish monetary control to a third party. That will never happen. FDR showed that when he was tired of gold hoarding so he just went and confiscated it all.

Besides, anything other than stablecoins are far too volatile to be an acceptable medium of exchange. Even stablecoins have broken pegs when managed by third parties.

Windy City Ag said:Quote:

The whole crypto Genius Act appears to be the infrastructure for the off-ramp from central money authority.

Giving corporations and banks the authority to create digital financial instruments that can be used as currency really undercuts the Fed.

No government wants to relinquish monetary control to a third party. That will never happen. FDR showed that when he was tired of gold hoarding so he just went and confiscated it all.

Besides, anything other than stablecoins are far too volatile to be an acceptable medium of exchange. Even stablecoins have broken pegs when managed by third parties.

You are 100% wrong. Genius act is THE way to move on from the Fed.

Also the government doesn't even have monetary control right now. Which is what this entire thread is about. And secondly it's not even the Fed that prints money. It's the banks but people have zero education on how our monetary system works.

Quote:

No government wants to relinquish monetary control to a third party.

Governments don't want to....they are being forced to. We are being ushered into Technocratic Oligarchy through hard core financial engineering.

Quote:

A technocratic oligarchy combines elements of rule by experts (technocracy) with rule by a small, elite group (oligarchy). It suggests a system where policy decisions are heavily influenced, if not controlled, by a powerful group of technically skilled individuals, potentially leading to a concentration of power outside traditional political structures

The last few years should be a pretty good indication that our votes don't really matter and politicians really don't care what we ***** about......

Quote:

THE way to move on from the Fed.

the off ramp from the central money authority.

Aren't those the same thing?